In a recent article about the Swiss watch glut, commentator Will asked “If there’s a glut, where are the watch discounts?” We at TTAW believe the question deserves a thoughtful answer. First, it’s important to understand the limits of supply and demand economics . . .

We all know the role that supply and demand plays in pricing. Supply curves slope upward, demand curves slope downward. Wherever the twain shall meet is what you’ll pay. This is such a simple and powerful rule that it works pretty much everywhere. However, how it works is intimately bound up with the mechanics of the particular market.

The law of supply and demand can exert an extremely strong and obvious influence on price. For some goods and services, changes on either side of the equation create an immediate price change. But the effects of reduced or increased supply or demand can also be stymied or opaque. Various mechanisms can prevent pricing from adjusting immediately or completely.

Simply put, simpler and more fungible goods create more liquid markets and the stronger version of supply and demand. There’s a reason economics textbooks use a commodity like grain or oil to illustrate these concepts. When you can freely substitute one good for another the market is going to be fully liquid; it quickly achieves a “market clearing” price. Think about how hurricanes change gas prices.

As products get more differentiated from each other the substitutability falls. Pricing becomes more dependent on inherent values of the good, rather than pure supply and demand.

When it comes to luxury goods like Swiss watches, there are a host of factors that come into play: pricing and distribution policies, geographic factors, fashion, media coverage, etc. Using pure microeconomics to determine “what the market will bear” is like looking through a dirty glass – the view is distorted compared to a simple commodity like oil.

One thing’s for sure: there have been Swiss watch gluts in the past. The financial crisis of 2008 is the most famous. The crash in demand led to some extreme behavior by manufacturers, such as Richemont’s decision to buy back and destroy unsold inventory (a practice it repeated as recently as a few years ago).

Many watchmakers pushed their inventory into Mainland China, which weathered the crisis better than any Western economy. This was a great strategy – until Xi cracked down on corruption. Swiss exports to the Mainland and Hong Kong plunged. (That affair is an article in itself).

The COVID-19 pandemic led to an unexpected, unanticipated global shutdown of the entire watch market, leading to a substantial oversupply. Despite ceasing production and slowly returning at reduced levels, demand has not yet caught up with supply (assuming it will). Which brings us back to Will’s question: if there’s a watch glut, where are the watch discounts?

The first thing to know: luxury manufacturers hate watch discounts. Discounts to the public detract from the product’s prestige. Watchmakers will do nearly anything to avoid them – or at least avoid the appearance that they’re providing them. They employ various strategies to keep official discounts at bay.

First: they push excess inventory onto dealers. We talk a lot about this at TTAW, for good reason. The practice is an evergreen. By withholding allocation of desirable pieces, manufacturers make dealers eat excess inventory. Then it’s the dealer’s problem; the dealers either holds onto pieces until they sell or . . . discount them.

Dealers tend to offer customers discounts sotto voce. Once they establish you’re a serious buyer, they close the deal by offering you a piece at a price significantly lower than MSRP. That’s nothing you’ll ever discern by looking in the window or scanning the dealer’s website (policed by minimum advertised pricing rules).

Unofficial dealer discounts are still the most common method for dealing with gluts. That said, the rise of the other strategies has made it a less prevalent practice

The second strategy (one manufacturers are practicing now): hold pieces back. The manufacturer’s markup to their retailer is around 100 percent plus. Not selling a watch at $20k is a much smaller hit to the manufacturer than it appears at first glance.

What happens to these watches? Sometimes they’re put aside to be released later. Many times they’re pulled apart. Movements end up in different/newer cases and everyone is happy. Eventually.

In a bad year – and this has been a very bad year – watch manufacturers hold allocations back to prevent a glut. Either that or they quietly buy back pieces from their wholesalers or dealers to make sure that the price doesn’t crash (a la Richemont).

Dealers are happy to sell a piece back to a manufacturer. They can use the good will engendered with the manufacturer to secure in-demand watches. The watchmaker either relocates the unloved watches geographically or, again, tears them down for parts for more popular ones.

Finally, most importantly, dealers use the secondary market to offload excess inventory.

A few weeks ago we talked about the “importance” of the secondary market. Despite WatchPro’s insistence that the secondary market is for “data and research,” it is absolutely used to dump excess inventory.

TTAW has done some digging. We know for a fact that some manufacturers are either pushing pieces on to the secondary market themselves or through trusted third parties, condoning dealers and/or wholesalers to tap the secondary market on their behalf.

Since these are not “new” sales, the manufacturer maintains a level of plausible deniability. And while shuffling new watches onto the secondary market might hurt “collectors” or “investors,” the manufacturers don’t give a fig about these people. They’re happy to get their pieces in the market – as long as they don’t compete with dealer or direc-to-consumer prices.

To see how this works, let’s check in with a manufacturer that doesn’t have a glut. Here’s Rolex’s current availability on Chrono24:

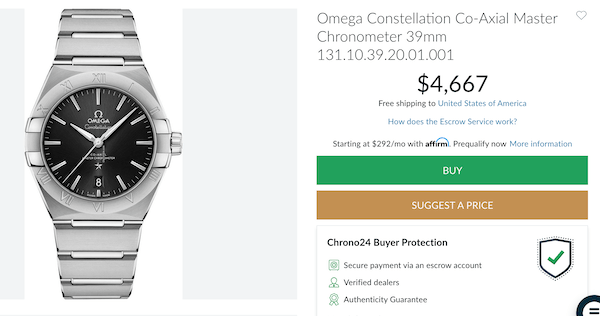

See that? Some new pieces, a lot used. That’s exactly what you’d expect from a functioning market. Now let’s look at crosstown rival OMEGA.

What about Tissot?

Here’s Longines:

This is a fairly crude metric. But well functioning markets do not have the majority of their inventory on secondary sites as new/unworn.

So where are the discounts? They’re right there! The Longines HydroConquest retails at $1,600. Chrono24 has them for 20 percent off, all day. Can you get a box fresh OMEGA Constellation in steel for 25 percent off? Yesiree Bob! And so on.

If you’re looking for easy access to new watch discounts, you’ll find them on the secondary market. Sure you’re sacrificing the manufacturer’s warranty, and you’re not going to find a new Rolex Submariner for a discount. But a market where brand new pieces are going for 25 percent below retail reveals a significant glut. A broken market.

Always weird seeing your comment show up in an article. I suppose you can get a discount from Chrono24, but I would think that the important part is getting it to show up in pricing from an AD. I think that’s where the disconnect is because I’ve emailed people on Chrono24 asking for a discount, and some wouldn’t budge….Can’t even offer a price at Hodinkee! lul

Good write up.

It deserved more attention than just jumping in!

I agree with you on AD pricing. They’re pretty restricted by their marketing agreements, so discounts are generally hugely low-visibility. For example, I got a pretty deep discount on a Speedmaster Racing from an Omega AD, but it required another AD to act as a go-between. Seeing a price lower than MSRP on Chrono often means you can get something similar from an AD if you go in physically and ask.

Excellent article. A fantastic read.

I’ve heard that ADs of the most coveted brands actually surreptitiously sell to the black market by way of proxies to capture the market value of their inventory. Eg, telling a co-conspirator “here, sell this Submariner on Chrono and keep 15pct for yourself.” And this renders the dealer “waiting list” for hot pieces even more of a joke, because ADs are just shooting their best pieces right out the back door to the secondary market. Wonder if that’s true?

I have heard from Rolex ADs that this is absolutely true (not that they’re admitting it, but that their rivals do it, natch). There’s also a “buy a bunch of pieces we would normally discount at full price and get this hot piece that you can then go sell and make all of your money back and more” thing going on.

100% markups?!

Rolex ADs get 38%. Other brands vary (can’t claim I know all of their setups) but that’s not far from what is likely average.

Your posts are part fun, part insightful, and a lot of clickbait and general negativity about the fun that is luxury watches. Those two aspects, plus the more than occasional total miss on key figures, kind of annoying still.

If we miss, let us know so we can correct it. (The post says the manufacturer makes 100 percent. Not the AD.)

Typically you usually keystone (*50% markup) most watches and jewelry. I’d be surprised Rolex was 38% tbh. I think by 100% he meant double cost.

Using Swatch group results from 2019 (since ’20 was weird), they did net sales of CHF 8.2B with COGS of CHF4.4B, which is almost a 100% gross markup from cost of production.

That COGS numbers is overstated since they wind ALL personnel costs into a single line item, so all S&M and G&A are included in that. So their true GM is well north of that.

When you do find a total miss on figures please do let us know. We are pursuing the Truth, after all.